Knowing Is Growing: Identifying Your Ideal Target Advisors and Influencers

Effective advisor engagement begins with an understanding of the ideal advisors and influencers for your investment products and offerings.

Your marketing success will depend on strategies and programs that rely on accurate identification and targeting of market segments. Depending on your business model, you will target a variety of different advisor audiences. You might consider the top-level groups like Wirehouse FAs, Independent BD firms and independent/Fee Only RIAs and Hybrids. But these groupings do not go far enough to properly tailor your advisor engagement strategy. Engagement strategies will vary significantly across these groups and even further within each group. There are a wide range of advisor types and styles that you must consider when crafting an engagement strategy.

An effective advisor engagement strategy requires a deep understanding of how your investment offerings fit with the target groups, subsegments and the size and economics of each sector.

Yet too often, our marketing and communications efforts are not targeted towards the most promising target segments. The benefit of improved segmentation is the ability to drive sales by crafting differentiated communications, deploying customized marketing programs, aligning distribution strategies and improving marketing and sales focus.

So how do we identify our ideal advisors and influencers?

The answer is to segment the market around criteria that matter.

Understand segmentation and the factors in your business model that should determine the ‘ideal advisors’.

- Segments should have similar preferences within each segment and distinct preferences between segments.

- Segments should be actionable for purposes of marketing planning and sales execution.

- Segments should consider a range of factors that matter to your offerings, (e,g. financial viability in terms of size, scale, margins; investment style, e.g. discretionary vs non-discretionary, etc.)

Go beyond groups (like Wirehouse, Indy, RIA) and consider factors that distinguish advisor’s likely interest, fit and engagement styles. Examples you might consider are:

- Advisor business model

- Advisor value proposition (e.g., wealth manager, investment manager, stock picker)

- End client interaction – proactive vs reactive

- Portfolio Management Approach: discretionary vs non-discretionary

- Product/Market Mix – expansive or niche/limited vs full portfolio

- Current relationship – established vs new

- Position among peers – opinion leader vs trend follower

- Stage in career: Ramping up, established, finishing up

- Organization: Lone wolf, small team, office

- Specialization within team: relationship vs product leadership

- Channel preferences: wholesaler vs online/self-directed

- Communication preferences: email vs letter/newsletter vs brochure

- Education: direct/wholesaler vs webinar/video/TV

- Awareness model: advertising vs product search

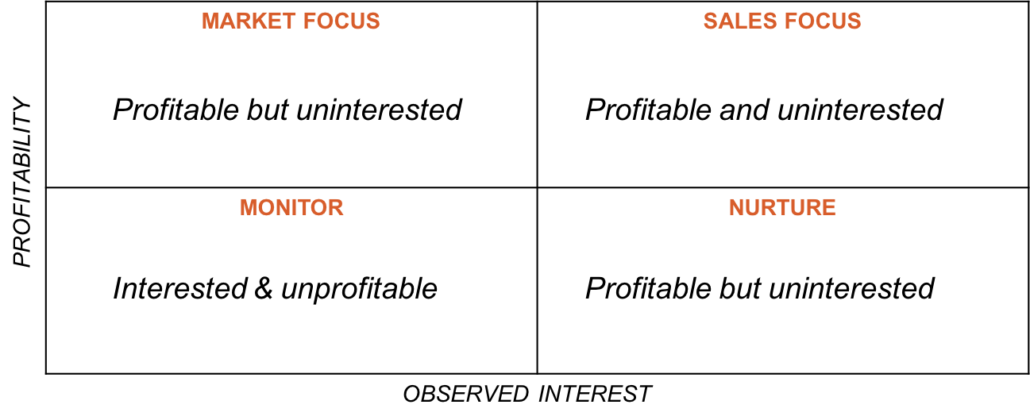

Identify and focus on the segments that work for you

- Reviewing existing and/or planned segments in light of your business model

- Identify and measure Total Addressable Market (TAM) so you can better measure awareness and engagement levels

- Prioritize your target audience (e.g., by discretionary/non-discretionary, firm size/AUM, shared attributes, etc.)

- Identify target audience buyer composition (e.g., personas, DMUs (decision making units) and influencers

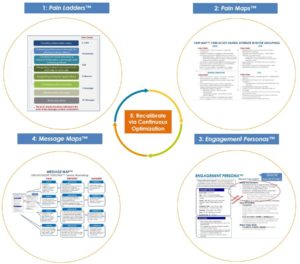

Note: the author of this post is indebted to the work of Keith Sullivan in his comprehensive guidebook, “Exposed: The False Promises of Revenue Marketing” and the deep insights he provides into the 9 principles of buyer engagement.

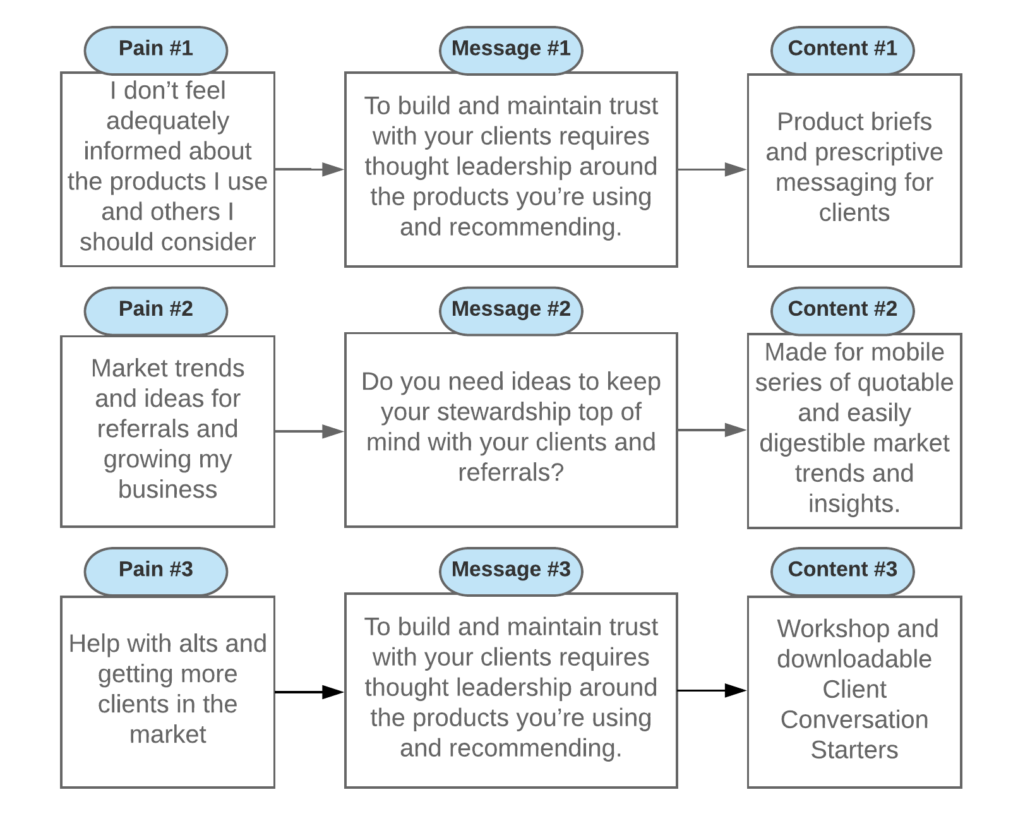

See illustrative metrics, listed hierarchically from most important to least important

See illustrative metrics, listed hierarchically from most important to least important