It Takes Four: the Foundation of Stronger Advisor Engagement

Do you have the right foundation for advisor engagement?

We break down the resources and systems that asset management firms need for effective advisor engagement into four categories:

- Brand: Do our firm’s brand positioning, visual communications and branded channels provide a communications platform for advisor engagement?

- People: Are our organization and talent prepared to effectively engage advisors across the end-to-end advisor lifecycle?

- Processes: Are we executing a closed-loop process to engage advisors across the end-to-end advisor lifecycle?

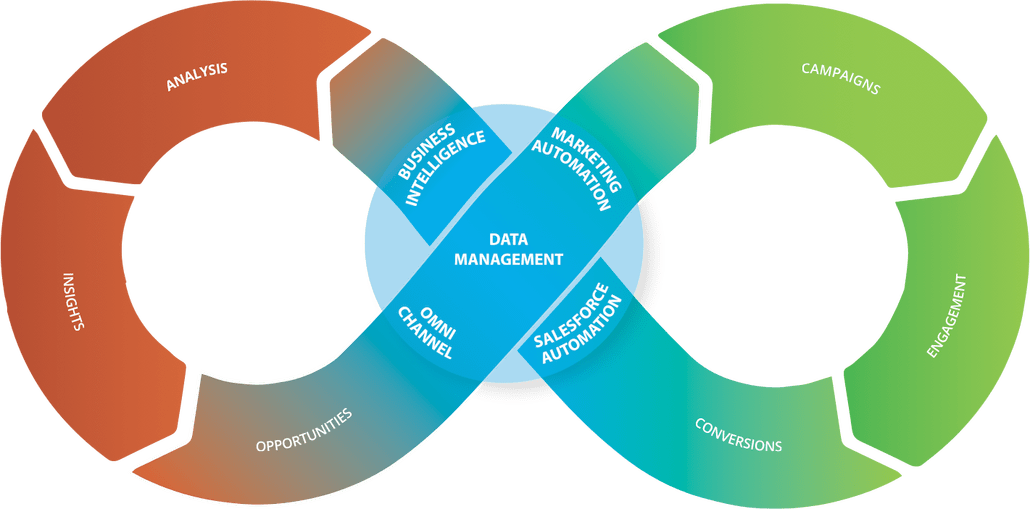

- Technology: Does our solution include the right “stack” of revenue technologies including digital channels, marketing automation, salesforce automation, data management and business intelligence/analytics?

These four resource categories make up what we call a “revenue system”. They form the foundation for advisor engagement and sustainable revenue execution. These resources need to be in place at a sufficient level of maturity to enable revenue teams to attract, nurture, deepen and expand advisor relationships and convert asset management sales. Yet few asset management firms have the right mix of capabilities across these categories. Brand channels and communications, messaging and voice are often not competitively distinguished and consistently communicated. The organization and talent approach is often siloed, creating disjointed advisor engagement for self-directed advisors and revenue processes are not “closed-loop” where marketing activities and programs are tracked through sales, informing what’s working and how to re-shape program tactics. Finally, technology systems are often not fully integrated, thereby resulting in poor data quality and less-than-ideal automation effectiveness.

Today’s advisor lifecycle experience is fluid and self-directed. Messages and experiences must be consistently delivered across marketing and sales. Leaders recognize that marketing and sales teams come together to manage non-linear advisor journeys. So, what are the resources required for an effective revenue system?

We break down resources into a checklist of four systems categories for world class advisor engagement.

Brand

Pervasive experiences, impressions and visual communications that reinforce a differentiated position.

- Consistent brand identity and visual communications including logo design, tone and imagery colors embodied in a consistent brand standard

- Brand enablement of 3rd party distribution and direct channels including digital and direct.

- The digital presence across web and social media – with consistent copy, content and visual identity

People

Organization and talent that bring a holistic understanding of the integrated front office and teamwork.

- Revenue-first organization that puts advisor experience first

- Collaborative culture

- Innovation focus

- Technology and digital savvy

- Recruiting and talent development

- Metrics and incentives to reinforce the right behaviors

Processes

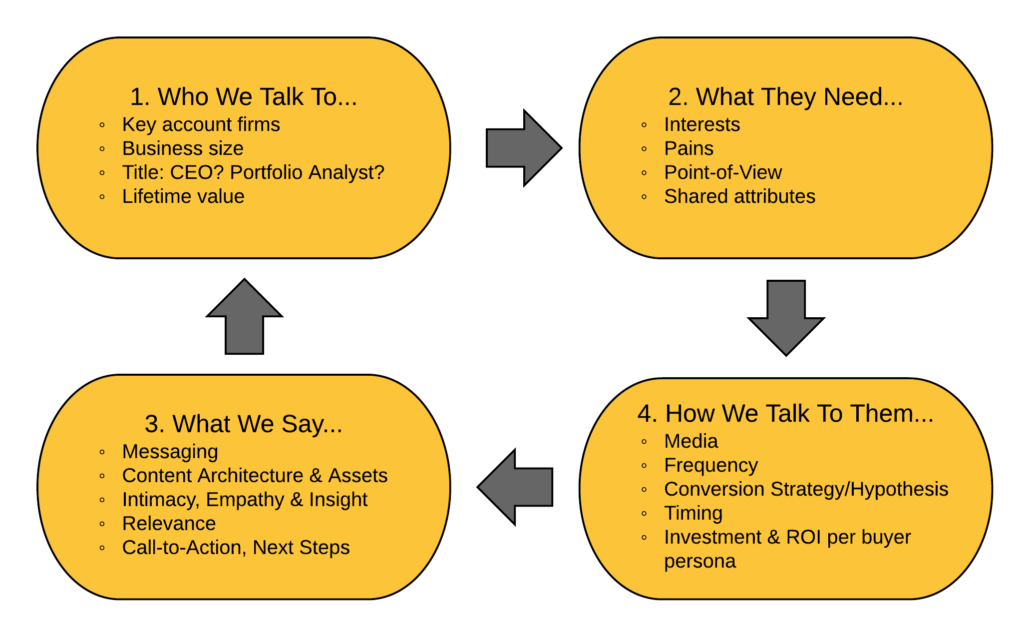

A continuous closed-loop process that eliminates “marketing” and “sales” language in favor of a revenue-focused approach and process.

- A closed-loop process that recognizes the continuous and non-linear engagement of today’s financial advisors, teams and influencer communities

- Embracing the concepts of equitable exchange and permission marketing to deliver value in exchange for value

- Orchestration of advisor engagement strategies for high profile/high value accounts

- Closed-loop tracking and intelligence about what is working and not working across the lifecycle engagement model

- Enabling content and resources that support real time aadvisor engagement and that addresses true persona needs and pain points.

Technology

Marketing and technology stack that includes applications for marketing, sales and data management.

- Channel Platforms (web, social advertising, PR)

- Marketing Automation & Tools

- Sales Force Automation

- Data Management

- Business Intelligence Analytics

Note: the author of this post is indebted to the work of Keith Sullivan in his comprehensive guidebook, “Exposed: The False Promises of Revenue Marketing“ and the deep insights he provides into the 9 principles of buyer engagement.

This post addresses the 9th and final Principle.