R Stands for Relevance: Marketing Automation That Works

Financial advisors are an amazingly difficult prospect to engage. They are incredibly busy and already have a wealth of resources available to them; in fact, it may be fair to ask if they even need to engage with wholesalers? That’s why we say the best way to convert financial advisors to customers is to build your marketing automation program around them.

Lead generation starts with effective segmentation

Before focusing on key strategies, Sales and Marketing must have defined a set of engagement personas and customer segments. Marketing has worked with personas for at least a decade, but only since the advent of marketing automation software have engagement personas become empowered and brought to life.

Defining financial advisor segments for lead generation

Creating clarity with Sales is a two-step process:

- Lead scoring – a measure of how active a financial advisor is on your digital properties

- Lead grading – a measure of how profitable the financial advisor is likely to be

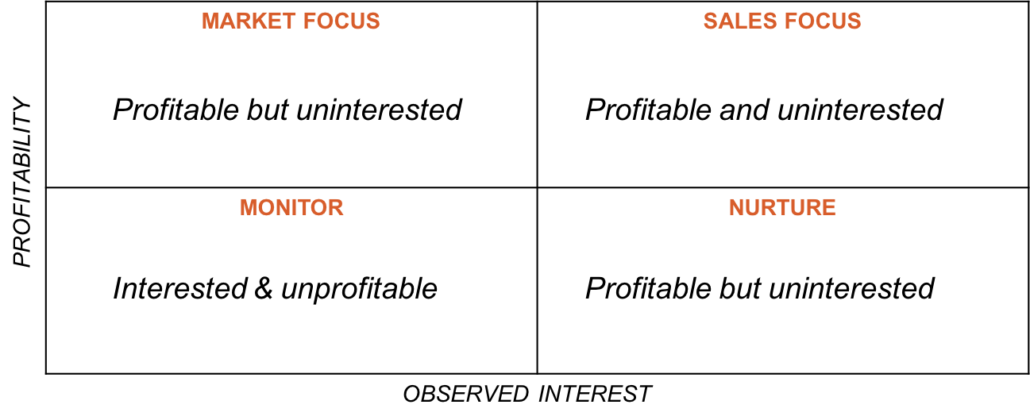

While it may take several iterations to get lead scoring and grading optimized, the process should be fruitful for Sales and Marketing. It crystallizes Marketing and Sales perspectives around which advisors are most profitable and which digital behaviors are believed to be most relevant to a sale. Some marketing automation vendors have one score that represents profitability and interest. However, being able to separate advisor behaviors from profitability factors simplifies discussions by clarifying customer segments by profitability as seen in the above graphic. As an example, Pardot applies a numerical value for an advisor’s lead score and a letter grade (A-F) for an advisor’s expected profitability.